The Weekly Accounting Story

Before starting Weekly Accounting, we built an inventory financing business called Assembled Brands, a $100m fund that lends money against the inventory of emerging consumer brands.

To start the business, we found 150 different consumer brands. Then built an Integrated Financial Model for each of them plus gave them a consultation with an experienced CFO.

From there we

- saw financials from over 3,000 businesses

- invested in over 120 of them.

What we learned

- We proved that a handful of key metrics are a great way to predict the success of emerging consumer brands

- This became our investment criteria.

- More than half the brands had fluctuating gross margins indicating poor balance sheet accounting.

- Few brands were doing proper revenue recognition.

- Less than 15% had great inventory forecast models.

- Less than 5% really understood their unit economics properly.

All of this indicated small businesses are woefully undeserved by their outsourced finance and accounting partners/teams.

So, we decided to put our time towards where we could help the most…

Building a platform for small businesses to see and manage their business better.

[Sources]

Introducing Weekly Accounting

We took those issues in financial insights as the baseline for the Weekly Accounting financial tool…

Our Integrated Financial Model: An everyday, easily accessible financial model to understand daily successes, failures and metrics to accurately determine the future performance of the business.

We built Weekly Accounting to give all companies no matter the size, the financial insights and instruments that only companies with large resources can afford.

- The Revenue Engine

- The full Customer Acquisition funnel Breakdown

- Full Unit Economic Breakdown & Analyze

- Inventory Forecasting

- Accurate Profitability, Cash Flow, and Budgeting Analyze

Then, we made it simple and accessible via Google Sheets and our propriety displayed system:

- Monday Morning Metrics: The perfect weekly view to see and manage the business

- Integrated Financial Model: The perfect monthly, quarterly and annual view to forecast cash flow, financing requirements and valuation.

A quick aside:

“The structure of our language affects our structure of thinking and thus our perception of the world.”

Weekly Accounting is a language

But before there is language…

There Is Intention.

Traditional Accountants tend to ignore data from any system other than the bank. That would be like listening to an orchestra and only hearing when the letter F was played.

Traditional Accountants intention is compliance. IRS rules, Accounting rules…

Neither of which help you run the business.

We are not an accountants.

Instead, we are engineers who have become financial officers. Specifically the founder was a Sonar System Engineer.

A sonar gathers data, analyzes it, and presents a map of that territory from said data.

That’s what the Weekly Accounting System does for your business.

Our intention:

- help you see their businesses better

- help you grow and sustain growth

- help you optimize the balance between growth and profitability

To do that we gather data, analyze it, and present a map of your business.

The Views of The Weekly Accounting System

When we implement the Weekly Accounting System at a company, we start by integrating the data from every business application into the Weekly Data Warehouse. From there we transform the data and do the required calculation to present it in the form of an Integrated Financial Model and Monday Morning Metrics. An image of each is below.

Integrated Financial Model View

Monday Morning Metrics

System breakdown:

1. The Revenue Engine

A Revenue Engine is how a business reaches and sells to its customers and then how it gets paid for and delivers a result.

The Revenue Engine is like the dashboard on a car – a set of numbers that indicate the performance of the engine and the car on the road. When we “instrument” a revenue engine we are focused on the information necessary for calculating the unit economics.

The sections of a revenue engine in language that works across industries include:

- An audience & a conversion rate

- New customers & repeat customers

- Unit economics

- A simple cash based P&L

From this perspective, each company in each industry might have slightly different naming conventions, but from a meta-level, when financial modeling and forecasting are important, it’s all the same.

The revenue engine of an e-commerce businesses instruments how the company reaches, converts and delivers its product to its audience as in:

2. Customer Roll-forward

A customer roll forward gives us the ability to accurately forecast a business. Showing us where the business is in their business cycle.

This way we can easily see how much sales and growth are possible in each channel the business is pursuing.

Improving the business’s knowledge for the business to make decision-making to improve their performance.

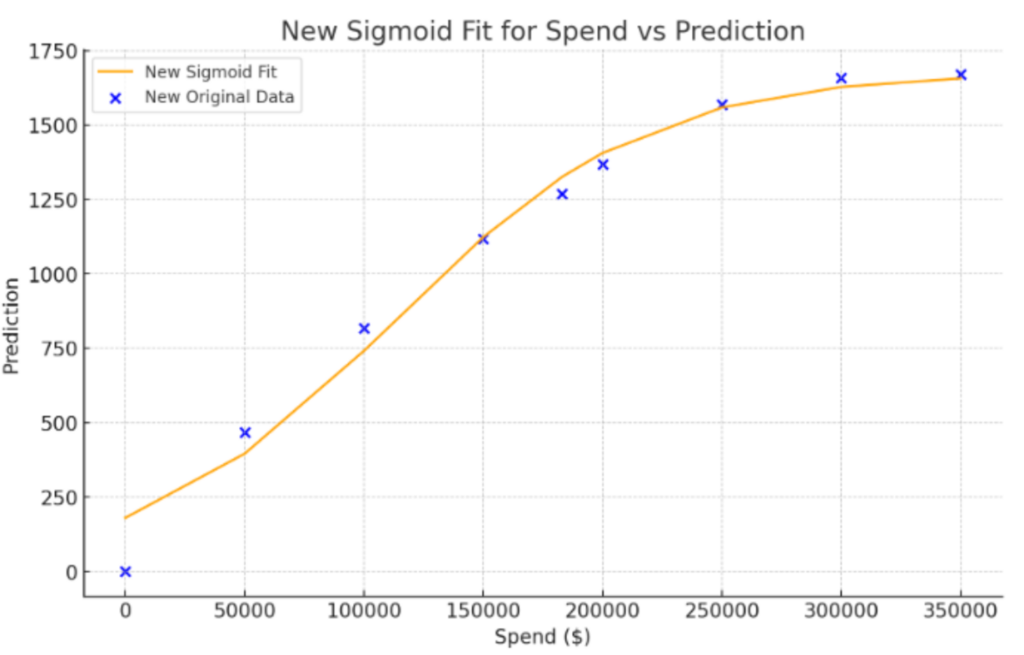

3. Trends in Unit Economics

Traditionally an important metric in the digital marketing world has been Lifetime Time Value (LTV) of a customer or the Customer Acquisition Cost (CAC). Many investors then take LTV/CAC to determine the companies likelihood of success for that company. What we have found after our thousands of financial analyzes is this ratio is meaningless for two reasons:

- Lifetime Value is an ambiguous word. Most people calculate it as Lifetime Revenue.

- If we are really just looking for the revenue from one customer, we should instead be looking for the profit.

- For that reason we use a metrics we call LTGP or Lifetime Gross Profit.

- When presented as a single metric that merely represents a point in time or a period of time. Trends in this ratio have a direct correlation to how big the company can grow.

- When analyzing LTGP/CAC, we “sample it” over time. We sample it Weekly, Monthly and Quarterly and Cumulatively.

- Looking at LTGP/CAC cumulatively gives us a baseline performance metric for the entire history of the company. Cumulative CAC is calculated by taking all the Ad Spend in the history of the company divided by all new orders from first time customers.

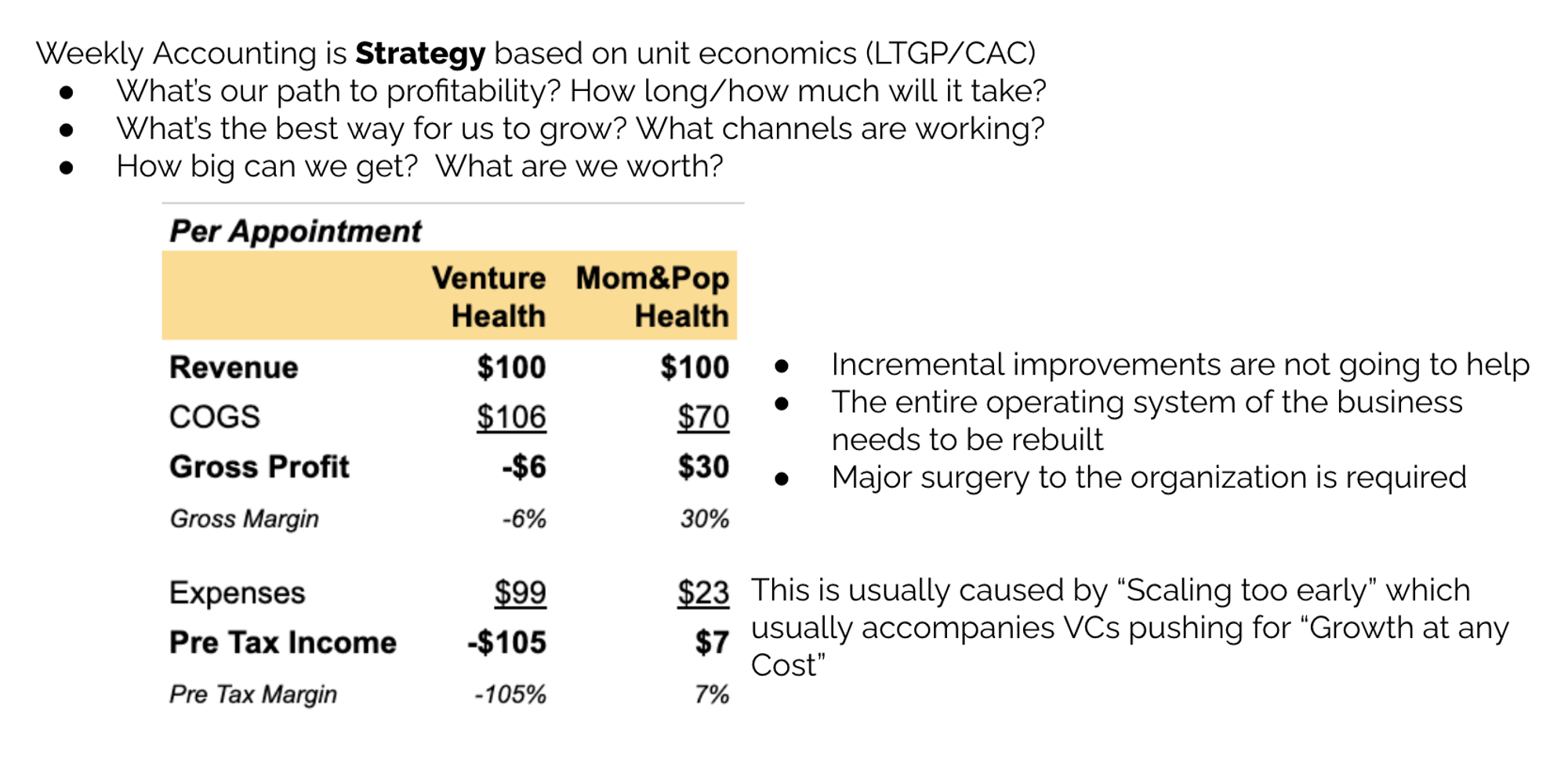

4. Strategy Based Unit Economics